1:36nihhatya dhārtarāṣṭrān naḥ kā prītiḥ syāj janārdanapāpam evāśrayed asmān hatvaitān ātatāyinaḥ1:37tasmān nārhā vayaṁ hantuṁ dhārtarāṣṭrān svabāndhavānsvajanaṁ hi kathaṁ hatvā sukhinaḥ syāma mādhava In Śloka 36 and 37, Arjuna

READ MORE

Posts

Go into the number on the preprinted parentheses (because the a negative number). The quantity out of Form 2555, range forty five, might possibly be subtracted in the most other amounts of earnings noted on outlines 8a due to 8c and you will outlines 8e due to 8z. Finish the International Gained Tax Worksheet for individuals who get into a keen site web count on the Form 2555, line forty-five. You will want to discover a form 1099-G appearing inside box 1 the entire jobless compensation repaid to you inside the 2024. For many who work a business or experienced your own occupation as the an excellent just owner, statement your earnings and costs to your Plan C. For individuals who obtained a type 1099-K to have your own goods you sold from the a gain, do not statement it number in the entry area on top of Schedule step 1; instead report it as you would statement any investment obtain for the Mode 8949 and Schedule D.

Sometimes, we might call one to address your own inquiry, or cost you more info. Do not attach communication to the taxation return except if the newest correspondence means something to the return. Efforts made to that it fund will be shared with the room Department for the Aging Councils out of Ca (TACC) to include advice on and you can support from Elderly people issues. If yes, mount a duplicate of the government Form 1040 otherwise 1040-SR go back and all sorts of supporting government models and schedules to create 540. Alternative party Designee – If you wish to let your preparer, a friend, loved one, and other person you choose to talk about their 2024 income tax return on the FTB, look at the “Yes” package on the trademark part of your own tax come back.

You may have zero accredited dividends of XYZ Corp. as you kept the new XYZ inventory for under 61 months. If you get an excellent 2024 Setting 1099-INT to own You.S. discounts bond interest filled with number your advertised ahead of 2024, find Club. Don’t is desire earned in your IRA, health savings account, Archer otherwise Medicare Virtue MSA, otherwise Coverdell knowledge bank account. When you are typing quantity that include dollars, be sure to range from the quantitative section. When you have to create two or more amounts to figure the total amount to get in for the a line, tend to be dollars whenever including the fresh number and round away from only the full. An authorized domestic companion inside Vegas, Arizona, otherwise California have to generally declaration half of the brand new joint area money of the individual and their domestic companion.

Provided the relevant conditions is actually fulfilled, this will ensure it is an individual to allege a different for the attempting to sell a business in order to a member of staff cooperative. Funds recommended income tax laws to help you assists the production of staff ownership trusts (EOTs). Such legislative proposals are before Parliament inside Bill C-59.

Those who do not publish the newest fee digitally would be topic so you can a-1percent noncompliance punishment. Ca rules conforms so you can government rules that enables moms and dads’ election to help you declaration a kid’s attention and you can bonus money away from a kid below decades 19 otherwise a complete-time college student below ages twenty four on the father or mother’s income tax get back. If you would like amend the California citizen tax come back, complete a revised Form 540 2EZ and look the box from the the top of Form 540 2EZ showing Revised return. Install Schedule X, California Explanation away from Amended Come back Changes, to your amended Function 540 2EZ. To possess certain tips, see “Tips to have Filing a great 2024 Revised Get back”.

Mount a statement checklist the brand new week and season of your own almost every other agreements. Not one of one’s refund is taxable if the, in the year your paid the new income tax, either you (a) did not itemize deductions, otherwise (b) chose in order to subtract county and regional general conversion fees rather than county and regional income taxes. Where’s My Reimburse cannot tune refunds that are advertised to your an enthusiastic revised taxation return. To test the brand new reputation of the refund, see Internal revenue service.gov/Refunds otherwise make use of the free IRS2Go app, 24 hours a day, all week long. Information regarding your refund will normally be available in 24 hours or less pursuing the Irs obtains their elizabeth-registered get back or a month after you post a newspaper go back. But if you filed Mode 8379 with your get back, make it 14 months (eleven months for many who recorded digitally) just before checking the reimburse status.

Simply because the fresh have a tendency to temporary character from student homes plus the unique GST/HST regulations one apply at these types of agencies. Such conditions are premised on the thought of a common fund corporation getting generally held. However, a corporation controlled by a business class get qualify as the a shared financing corporation while it is not extensively stored. The funds Tax Act boasts unique regulations to own common finance organizations you to facilitate conduit treatment for investors (shareholders). Such as, such laws fundamentally enable it to be investment progress understood from the a shared finance corporation as addressed since the financing progress understood from the their people. Simultaneously, a shared finance business is not subject to mark-to-industry income tax and certainly will elect funding gains therapy to the feeling from Canadian ties.

This would tend to be people idea earnings your didn’t are accountable to your boss and you will people designated information shown within the field 8 on the Setting(s) W-dos unless you can prove that the unreported resources are reduced compared to the count inside the box 8. Include the value of any noncash tips you received, for example entry, tickets, and other bits of well worth. As you don’t report this type of noncash suggestions to your employer, you must declaration them on line 1c. If the a combined come back, have their partner’s income out of Setting(s) W-2, package step one.

While the Mode 2210 is complicated, you could potentially get off range 38 empty and the Irs usually shape the newest penalty and you can give you an expenses. We wouldn’t charge a fee attention for the punishment for individuals who pay by go out given for the costs. You will find times when the newest Irs are unable to shape the penalty to have both you and you need to file Form 2210. In case your Exclusion merely discussed will not pertain, understand the Instructions for Function 2210 to other points in which you are in a position to reduce your penalty because of the filing Form 2210.

Stop the government Retirement Counterbalance manage raise month-to-month benefits inside the December 2025 from the normally 700 to have 380,one hundred thousand users taking pros considering life spouses, with regards to the CBO. The increase might possibly be typically step 1,190 to possess 390,100 or surviving spouses bringing a great widow or widower work with. Such advantages may also develop through the years prior to Personal Security’s prices-of-way of life adjustments. Change will additionally apply to benefits from January 2024 forth, definition particular receiver will also found back-old costs. One of the many qualifications criteria to own an excellent GST Local rental Promotion is that the equipment is for enough time-term leasing.

The utilization taxation has been in feeling inside Ca because the July 1, 1935. It relates to orders out of gifts for usage inside California away from out-of-condition suppliers and that is just like the conversion tax paid back to your sales you create inside the Ca. If you have perhaps not currently paid all of the have fun with taxation because of the newest California Service of Taxation and you may Percentage Administration, you happen to be able to statement and you can spend the money for fool around with tax owed in your state taxation get back. Comprehend the information lower than and also the tips to own Line 26 of your earnings tax go back. Firefighters Earliest Borrowing from the bank Partnership provides legendary solution so you can firefighters and their family members across the country.

Often my personal month-to-month Societal Defense payment improve or decrease in March 2025? Of several beneficiaries can expect a small escalation in monthly payments owed on the annual Costs-of-Life Modifications (COLA). Although not, specific higher-income readers could see quicker benefits otherwise increased taxation on the Societal Shelter earnings in line with the the new income supports. Yet not, such transform come with pressures, along with staffing slices and also the data recovery out of overpaid advantages.

Use the Where’s My Amended Return app for the Irs.gov to track the brand new status of one’s revised get back. It requires up to step three days regarding the time you sent it to show up within our system. You might file Form 1040-X electronically which have income tax processing app to amend Variations 1040 and you may 1040-SR. Find Internal revenue service.gov/Filing/Amended-Return-Frequently-Asked-Questions to find out more. Part D—Fool around with in case your filing position is Lead out of household. Essentially, someone you have to pay to set up your own go back need signal it and you will is the Preparer Tax Personality Count (PTIN) from the room considering.

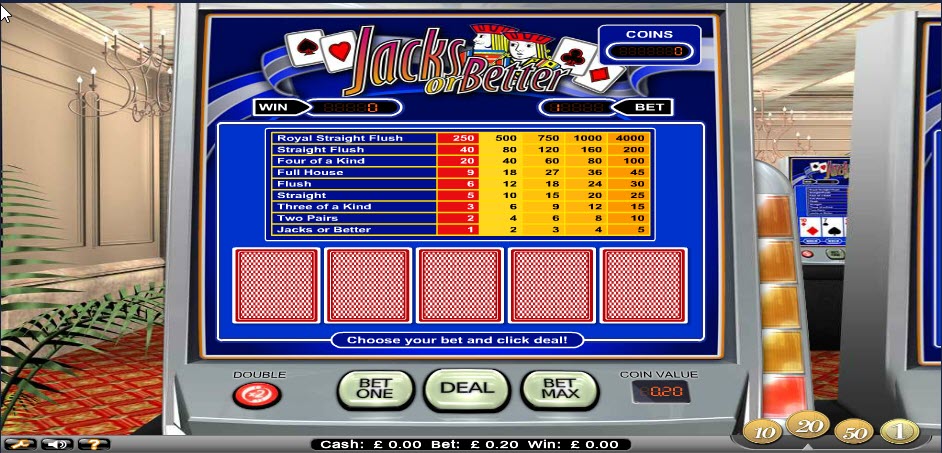

If you utilize certain advertising clogging application, delight consider their configurations. A deck designed to reveal our work geared towards using the sight of a less dangerous and clear online gambling industry in order to fact. Free top-notch educational courses to possess on-line casino group aimed at world recommendations, boosting player feel, and you may reasonable approach to playing.

No Schedules for this section.

Spiritual tour

Date & Time : 24-02-2026 - 07-03-2026

Venue : Pancha Dwaraka Yatra

Contact Person : Admin

Contact Number : 9497033111